family-law

family-law

How to Enforce Spousal Support in California

When your ex refuses to pay spousal support, is late on payments, or doesn’t give you the full amount, this can be understandably frustrating. Especially since the entire point of spousal support is to help a homemaker become economically independent after a divorce. Without this reliable, financial assistance, getting back on your feet becomes much more difficult.

If a judge included spousal support in your divorce order, it isn’t optional. Your ex might not like you, or agree with the verdict, but the hard truth is, that court orders are as iron clad as any other law—the only difference being, that it’s personalized to you. And California courts don’t look kindly on law breaking.

If you need to enforce spousal support in California, here’s how that might look in your situation.

Enforcing Spousal Support: Earnings Assignment

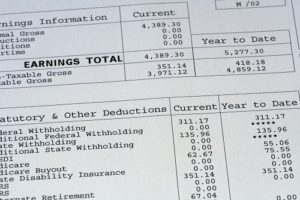

The easiest and fastest way to enforce spousal support in California, is to file an earnings assignment with your county clerk immediately after your divorce is finalized. An earnings assignment—also known as wage garnishment—is a legal document that requires your ex’s employer to pay you spousal support before giving them their take-home pay. This type of enforcement is automatically available to every California divorce.

Filing an Earnings Assignment in California

The only requirement to filing an earnings assignment, is that your divorce is finalized. Once you have your support order from the judge, activate your earnings assignment by completing:

- A Findings and Order After Hearing (Form FL-340);

- Any of the required attachments; and,

- An Earnings Assignment Order for Spousal or Partner Support (Form FL-435).

Upon completion, take the finished forms (and attachments) to your local clerk for signatures. After everything has been processed, you can pick them up and have copies properly served to both your ex and his or her employer. This is done via mail, and must be initiated by someone who is not a party to the case (meaning: you can’t do it yourself). Make sure to have your server fill out two proof of service forms (one for your ex, and one for the employer), as these will also need to be filed with the clerk.

Earnings Assignments Are Not Required

Although convenient and efficient, wage garnishment isn’t actually required. If both parties agree, an earnings assignment can always be “stayed,” or rather: put on hold. Though, it’s important to note, that a stay of earnings can always be reversed, if proper payments are not made on time in the future.

How Long Before an Earnings Assignment Takes Effect?

Once everything has been filed and served, your ex’s employer will have ten days to begin deducting spousal support from the paycheck. If they do not, the employer could be held liable for payments in your ex’s stead.

Enforcing Spousal Support in California: Other Tactics

If your ex falls behind on payments, or you are having trouble with an employer not meeting the terms of a valid earnings assignment, you may need to involved the court again. In these situations, a judge might reinstate an earnings assignment, or possibly hold an employer liable for noncompliance, if applicable. During this process, you will likely need to make an accounting of all missed payments, so that the increased amount can be included in the amount owed.

While it’s possible for you and your attorney to do these things on your own, if you are still having problems, at this point you might also want to consider soliciting outside help.

Local Child Support Agency (LCSA)

One way to get help enforcing spousal support in California, is to open a case with your local child support agency (or LCSA). The LCSA is authorized to help enforce orders of both spousal support and child support, and they can do so at no charge to you.

The biggest benefit to using the LCSA, is the arsenal of enforcement tools they have at their disposal—tools that certainly aren’t available to the average citizen. To enforce spousal support in California, the LCSA can:

- Report all late and missed payments to major credit reporting agencies, detrimentally effecting credit scores;

- Notify the U.S. State Department, who can place a holds on the passport of any individual owing $2,500 or more in support payments;

- Put a lien on your ex’s land or house, so that if the property is sold, profits can’t be collected on the proceeds until support payments are made;

- Suspend any state-issued licenses, including any driver’s, business, or professional licensures your ex might have;

- Use the Franchise Tax Board to collect money from bank accounts, real property, deposit box cash, or even vehicles owned;

- Notify the IRS to take support payments out of tax refunds before they issue anything to your former spouse;

- Take the owed support out of unemployment benefits, or workers compensation; and even,

- Claim lottery winnings—if your ex happens to be so lucky. (And there’s definitely some satisfying karma in that, we think.)

As you can see, the tactics used by the LCSA are much more motivating than anything you can do on your own, and since they’re available at no cost to you, it might make a lot of sense to just skip the drama, and involve them in your case as soon as possible.

Contempt of Court

Contempt of Court

In extreme cases, it might be necessary to enforce spousal support by holding your ex in contempt of court. Unlike divorce cases, which are held in civil court, a charge of contempt is a very serious criminal charge, and could result in jail time.

When deciding on contempt, the judge will analyze whether or not the support was withheld on purpose—particularly if your ex was able to pay, but just decided not to. Because while you can’t (technically) get thrown in jail for being in debt, intentionally ignoring a court order can definitely get you there. This is usually a measure of last resort, though, and most judges will attempt to find a reasonable solution before putting anyone behind bars.

Spousal Support Modification

Because there are such serious consequences attached to not paying spousal support, if you are on the paying end and cannot fulfill the court’s order, it’s important you notify them as soon as possible. The court understands that life is unpredictable, and circumstances change. That’s why there are ways to modify a spousal support agreement—ones that don’t involve enraging the Powers at Be for not paying (which, really, is never a good idea).

Communication is the biggest key, here. As soon as you are aware of the change in circumstance, don’t wait. Notify the court, and fill out the necessary forms to initiate a hearing to modify. Amount changes cannot be applied retroactively, so acting fast is critical, as you’ll still be on the line for the original amounts, however long it takes you to get the wheels rolling.

Depending on the reasons for your request, the court may reduce the amount, though they’re unlikely to eliminate altogether.

Attorneys to Enforce Spousal Support in California

For many divorcees, spousal support is a critical means of income in the post-divorce era, and not receiving these funds in full and on time can be extremely stressful and financially crippling.

If you are entitled to receive regular spousal support, and are not getting it, we can help. Call us at (209) 989-4425, or get in touch online to schedule your consultation today. With our assistance, we can make sure you receive the funds you’re entitled to, without the stress and headache of going it alone.